It’s like having a personal assistant that keeps your financial records in tip-top shape. Oh, sales tax – the bane of many ecommerce sellers’ existence. Different states, different rules, and let’s not even get started on the Wayfair ruling. Well, that’s where accurate accounting steps in.

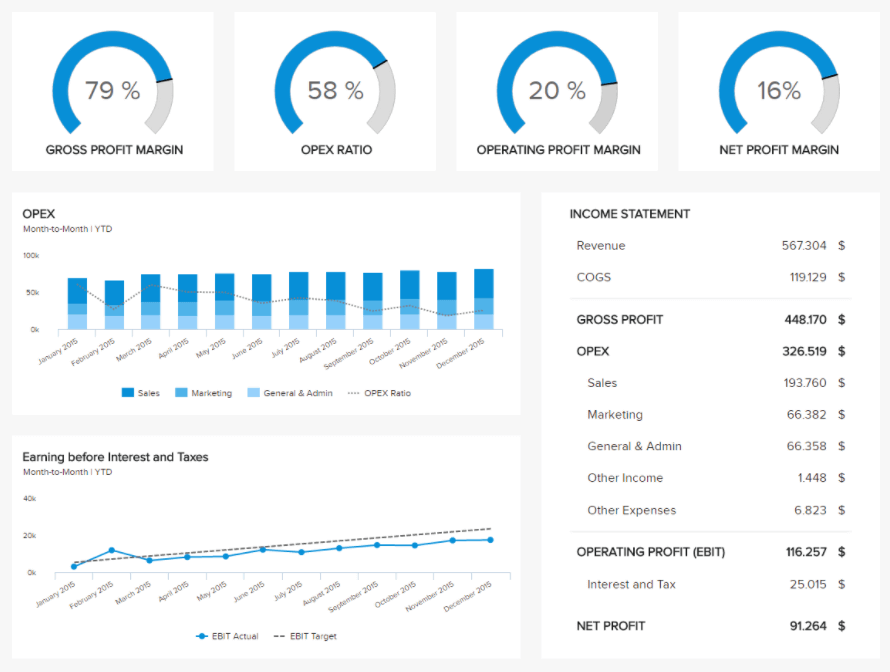

Analyze and optimize your performance

ECommerce accounting is a necessary part of your business. Regularly reconcile your accounts, review your financial statements, and ensure everything is in shipshape. The settlement amount includes a mix of sales, fees, refunds, taxes, and other transactions. It’s crucial to break down these transactions and record accounting advisory them accurately in your Chart of Accounts. Cash basis accounting tracks transactions when cash changes hands, while accrual basis accounting records them when the transaction occurs. Poor accounting will give you inaccurate financial data that leads to poor decision-making.

If you were to report the entire lump sum is depreciation a liability why or why not as “sales,” you risk over- or under-reporting your revenue. This can lead to over- or under-paying taxes, and then result in inaccurate data about your business performance. Properly categorizing each component of the settlement ensures compliance, accurate financial reporting, and a clear understanding of your business’s true financial health. Mismatches in revenue tracking can lead to inaccurate financial reporting.

Not only will it affect your decision-making, but others will have a false sense of how your business is performing. This makes it incredibly difficult to get loans, investors, and to sell your business. Proper accrual accounting requires revenue to be recognized when it is earned, regardless of when the payment is received. This means you should record sales that occurred in August within August and sales from September within September.

Previous PostUnlock Valuable eCommerce KPIs with the Power of the Diagnostic Toolkit

It’s challenging to know when to invest in more inventory, pay yourself more, increase your marketing efforts, or save some of that money for the future. For information on how to set up your chart of accounts, watch this video – Setting Up Chart of Accounts in QuickBooks Online | For Online Sellers. Bookkeeping is like the meticulous note-taker, recording every transaction and keeping your financial records organized. You get insights into your sales trends, cash flow, and overall business performance. Armed with this knowledge, you can steer your ship towards success with confidence.

Review payments and fees

- Regularly reconcile your accounts, review your financial statements, and ensure everything is in shipshape.

- If you find this to be true, read for more details on accurately recording COGS and why COGS matters.

- Inventory is your business, when COGS is high that means you have been holding onto inventory too long, or are not selling it at optimal pricing.

- If you were to report the entire lump sum as “sales,” you risk over- or under-reporting your revenue.

- It’s challenging to know when to invest in more inventory, pay yourself more, increase your marketing efforts, or save some of that money for the future.

It helps you track your real profits by considering all those general ledger nebraska hidden costs and fees that can eat into your revenue. When you know where every penny goes, you can truly celebrate your hard-earned profits. In both cases, it is important to reconcile these transactions accurately in your accounting system. A well-organized chart of accounts helps you categorize expenses, income, and assets, making your financial journey smooth and hassle-free. The inaccurate recording of COGS and inventory is more detrimental as your business grows.

For instance, if there’s a mismatch between tracking revenue and the Cost of Goods Sold (COGS), it can distort your profit margins. Ensuring that revenue and expenses are recorded in the correct periods helps maintain accurate financial records and provides a true picture of your business’s financial performance. A2X’s COGS feature is designed to help sellers better understand their gross profit margin (sales minus COGS). Accounting for the cost of inventory when it is sold provides a more accurate view on business profitability. It may be reflective of the way cash is moving through your business, but it does not accurately reflect the performance and profitability of your business. In addition, this method will show your inventory balance as zero.

You will get lost on how your business is truly performing, and the value of your assets will be inaccurate. As already mentioned, these problems become serious when trying to get investors, loans, or when selling your business. Inventory is your business, when COGS is high that means you have been holding onto inventory too long, or are not selling it at optimal pricing. This metric will be a good indicator of any changes that need to be made to your product lines.

Our team of ecommerce-accounting experts can handle the complexity while you focus on what you do best – building your business. Manually recording COGS and inventory can be complicated and time consuming. Once again, we recommend using A2X – (yes, get emotional again).

At the very least you will need to perform COGS calculations at the end of the year. We recommend doing this monthly for larger inventories. Any business owner knows that cash flow is essential, but that can be hard to get a good gauge on, too.