This can result in data becoming scattered across numerous categories, making it difficult to track and analyze effectively. Excessive categories can lead to confusion and errors in financial reporting, as well as a lack of consistency in the interpretation of income and notice to reader ntr compilation engagements expense categories. By leveraging QuickBooks Online’s categorization features, businesses can streamline their financial reporting processes and make informed strategic decisions based on accurate and detailed financial data. Next, review the existing accounts and identify any that need to be customized, added, or removed. You can then create new accounts by selecting the ‘New’ button and choosing the appropriate account type, such as income, expenses, or assets. Adding categories allows you to classify and track your income, expenses, and assets more efficiently.

Choosing the Right Category for Transactions

The accounts are organized in columns by name, account type, detail type, balance sales returns and allowances recording returns in your books in QuickBooks, and bank balance. Account types and detail types determine the data that shows up in financial reports like the Balance Sheet and Profit & Loss. It may hinder the identification of cost-saving opportunities or areas of financial inefficiency, impacting the bottom line and overall financial health of the enterprise. Therefore, prioritizing regular review and adjustment of categories in QuickBooks Online is pivotal for ensuring robust financial management and sustaining business success. Regularly reviewing and adjusting categories in QuickBooks Online is essential for optimal financial management, ensuring that the classification remains accurate and relevant to the business’s evolving needs.

How To Add Credit Card To Quickbooks

In QuickBooks Online, businesses can create categories specifically tailored for their products and services, ensuring accurate financial classification and reporting for their offerings. After importing categories, it is important to review and organize them within QuickBooks. Ensure that the imported categories are properly assigned, and any necessary adjustments are made. Businesses can create specific categories for customers and vendors in QuickBooks Online, facilitating streamlined financial management and reporting for client and supplier transactions. It is important to choose a meaningful name for your category that accurately reflects the type of transaction it will track. For example, if you are creating a category for office supplies, name it something accounting like “Office Supplies Expense” to facilitate easy tracking and reporting.

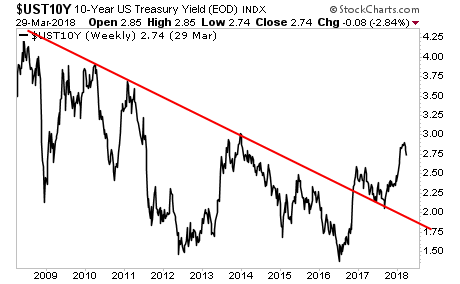

When you’re setting up your chart of accounts, choosing the right account type is crucial because your business’s accounting is built around account types. The account type determines which financial report QuickBooks adds each account’s data to. Choosing the right account type sets you up with accurate reports, such as the balance sheet and profit and loss reports, so you can analyze the financial health of your business. Neglecting the regular review and adjustment of categories can result in outdated or inaccurate financial reporting, leading to poor decision-making. It’s essential for businesses to strike a balance and ensure that their categories are well-organized and regularly reviewed for optimal financial management.

How to Use Categories in QuickBooks Online

By systematically categorizing transactions, businesses can easily monitor their cash flow, track expenses, and evaluate their revenue streams. This process enables them to generate detailed financial reports, such as profit and loss statements and balance sheets, which are vital for making informed business decisions. In summary, choosing the right category for each transaction is a crucial step in effective transaction management in QuickBooks. They play a crucial role in financial planning by allowing businesses to allocate specific amounts to different expense and revenue streams, thus enabling a clear overview of their financial position.

Understand the importance and purpose of account types

It is important to keep in mind that subcategories should be used judiciously, and the hierarchy should remain manageable. Therefore, consider creating subcategories only for significant and distinct transaction types that require further classification. QuickBooks automatically sets up your chart of accounts, but you can customize it to meet your business needs. You can also use account numbers any time, it is not required but your accountant may recommend them. These include accounts payable and receivable, asset accounts, liability accounts, equity accounts, and credit card and bank accounts. Here you’ll find a comprehensive breakdown of each account type and detail type available within the chart of accounts in QuickBooks Online.

- Matching transactions to pre-set categories is a vital step in streamlining your bookkeeping process.

- One such feature is the ability to add categories, which allows you to organize your financial transactions and track them more efficiently.

- This process allows users to categorize transactions, expenses, and income streams, providing valuable insights into various aspects of financial operations.

- Once you have defined the details of the category, you can continue adding and customizing additional categories to accurately track and report on your business transactions.

- In summary, matching transactions to pre-set categories in QuickBooks is a vital step in maintaining organized and accurate financial records.

With proper understanding and implementation, you can leverage QuickBooks’ powerful categorization features to stay organized, gain insights, and achieve financial clarity in your business endeavors. Furthermore, taking advantage of advanced features like importing categories from other sources can save time and ensure consistency with external systems. Utilizing tags for further classification provides a flexible way to track additional criteria that are specific to your business. And by splitting transactions across multiple categories when needed, you can accurately allocate costs and expenses across different areas of your business.

Regularly reviewing and updating split transactions helps ensure that your financial reports reflect the current state of your business. By leveraging the ability to create custom categories in QuickBooks, you can tailor your financial tracking to your business’s unique needs, ensuring accurate reporting and streamlined categorization. It is important to note that when creating custom categories, it is advisable to keep the number of categories manageable. Having too many categories can make the categorization process complex and time-consuming. Therefore, consider consolidating similar types of transactions under broader categories to maintain simplicity and efficiency. Overall, a solid understanding of categories in QuickBooks is fundamental for effective transaction management.

For example, if the category is for “Web Development Services,” you can add a description that includes the types of services included or any specific details related to billing or invoicing. It’s worth mentioning that tags can also be used in conjunction with categories and subcategories to provide even more detailed classification and reporting options. QuickBooks allows you to set up rules based on transaction descriptions, amounts, or other criteria. These rules can automatically match incoming transactions to pre-set categories, reducing the manual effort involved. Accurate categorization simplifies tax preparations and helps in the preparation of financial reports for stakeholders and investors.

Adding categories in QuickBooks Online is a simple and straightforward process that can be accomplished in just a few clicks. This flexibility allows you to tailor the software to suit your specific business requirements, providing you with the information you need to stay organized and in control of your finances. In the following sections, we will explore the steps you need to take to add, edit, and delete categories, as well as how to define the details of each category. When you categorize, QuickBooks puts your transactions on the correct line of your Schedule C. This also organizes your income and expenses so you know what areas of your self-employed business have the biggest impact. After you select your account type, select a detail type from the list that fits the transactions you want to track.